Have you ever asked your financial advisor why you must save money (create a Nest Egg) while you are in your working years? I believe the answer is quite simple. When you retire (or spend less time working) and spend more time enjoying yourself, you typically earn less income. Therefore, it is important to save money at a younger age, so that your savings can grow and ultimately produce supplemental income for you later in life. This is truly just a math equation that we are all trying to figure out. So, we must ask ourselves a simple question like, “how much income will I need each month to live in retirement?” The answer to this question ultimately depends on many factors including items like, how much will you earn in Social Security income or other income sources? What are your monthly expenses? How much do you want to travel and spend on leisure and recreational activities? What will medical, dental, and vision costs be that are not covered by Medicare or supplemental insurance? How much do you want to give or donate to family or charities?

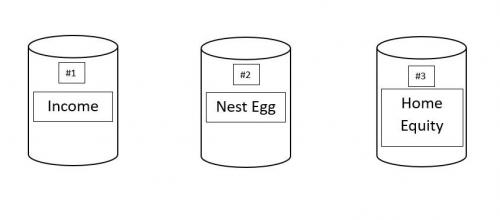

So, how do we plan for this unknown math equation as I call it? Well, that is where the 3 Buckets come into play. I believe that there are 3 buckets of money in retirement (if you own a home). Bucket #1 is your Income Bucket, Bucket #2 is your Nest Egg Bucket, and Bucket #3 is your Home Equity Bucket. When we are in our working years, we are producing an income and spending money out of Bucket #1. Remember, we are told that we must save for retirement, so we try to put money into Bucket #2 (fund a 401K, IRA, money market fund, CD, etc.). If you purchase a home, you also put money into Bucket #3 by putting money as a down payment on the home and by making monthly mortgage payments (the principal portion of your payment is what pays your mortgage down and creates more home equity). In general, we expect the money that we have saved in Bucket #2 to grow, and we expect our home value to go up/ appreciate as well. Therefore, when we go to retire, Bucket #2 (your nest egg) is hopefully worth more and Bucket #3 (home equity) has also increased.

Now, let’s look at what happens when we retire. Remember, Bucket #1 (our income) is typically decreased. Therefore, to maintain our lifestyle, cover expenses, travel, etc., we use money from Bucket #2 (our nest egg). In fact, there are tax rules that the IRS sets which require us to withdraw money from our retirement accounts at a certain age (this is called Required Minimum Distributions or RMDs). I believe the IRS sets these rules to force us to pay the taxes on these funds which have not yet been paid on those accounts. As we age, we continue to spend money out of Bucket #2 and pay taxes on these funds (except a ROTH IRA and life insurance). The challenge is that we really do not know how long we will live and therefore we do not know how much money we can spend and how much we must keep in Bucket #2.

So now let me introduce Bucket #3, your home equity bucket. Keep in mind that if you purchased a home, you put money into this bucket, your initial down payment, and every month you make a mortgage payment, you are adding more money to this bucket. Additionally, it is important to know that the average home appreciation rate in Northern Colorado was 9.5% over the last 10 years. That means that Bucket #3 has substantially increased in value and this bucket is now many retirees’ largest asset. Which means that Bucket #3 is larger than Bucket #2 in many cases. So here is the challenge…Bucket #3 is typically not accessible (I call this a non-liquid asset) unless you sell your home or get a mortgage. However, if you like where you live and you do not want to sell your home, the only way to access the funds in Bucket #3 is to get a mortgage or a home equity loan. Here comes the next challenge, do you take money out of Bucket #3 and pay it back using taxable funds from Bucket #2? That seems a bit silly and counter-productive, doesn’t it? Well, that is exactly what many people do when they get a Home Equity Line of Credit (HELOC) or a 30-year fixed rate mortgage. Therefore, the only option that allows you to access money from Bucket #3 (your home equity) without having to make a monthly payment, is a Home Equity Conversion Mortgage (HECM). You must still pay your property taxes, homeowner’s insurance, HOA dues, and maintain the home. By utilizing a HECM, you can spend less money from Bucket #2, which will allow you to protect your nest egg, allow your nest egg to grow over time and ultimately provide a larger nest egg for you to utilize over a longer period of time. This strategy is also a very tax friendly strategy because the funds that you get from Bucket #3 are not considered income and therefore you do not have to pay any income taxes on those funds.